What are the reasons for the prices in Forex?

For many traders, unfortunately, the reasons for the chart movement remain unclear. They only see what the terminal told them: trends, price increases and decreases. The more advanced ones are good for technical analysis. But technical analysis does not explain everything that happens in the Forex market.

Interestingly, price movements are quite predictable. There are a number of factors that determine the rise or fall of the value of currencies. But due to the large number of currency pairs and, most importantly, the large number of market participants with their opinions, the accuracy and efficiency of the analysis, even with excellent knowledge, is greatly reduced. If everyone opened deals in the same direction, then the market would move in one direction along the trend, with only banks and states suffering losses. But this is not happening.

What are the reasons for the prices in Forex?

However, the main price direction can be predicted by fundamental analysis and direction correction can be done by technical analysis.

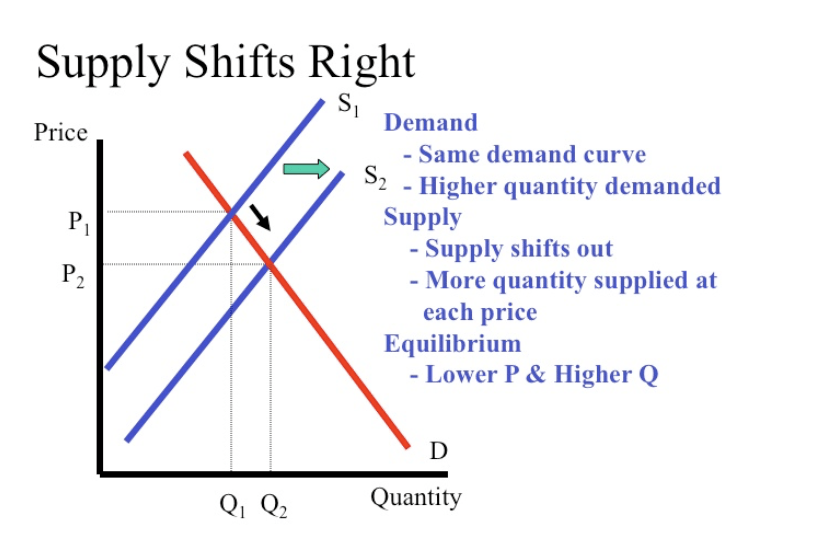

So what is the reason for prices in Forex? The forex market, like any other, exists because of supply and demand. In this case, the price of money is taken into account. But it is expressed in the price of another currency and a trading instrument is obtained – a currency pair. It turns out that, entering the terminal, we see the price of one country’s money when calculating with the money of another country, as strange as it sounds. If we find it difficult to understand the economic relations and the difference of situations in these states, we switch to another pair.

The current price at this time is the one at which the market/bank is ready to buy or sell the coin. It depends on the demand, on how much the buyers value the product. If no one is interested in such a purchase, the quotes stop. If many of those who have previously invested in it start selling, the price of the currency pair falls.

But this is only the tip of the iceberg. Yes, people make their choice in favor of this or that decision. But they also have reasons for that:

Formation of technical analysis figures on the charts, the so-called patterns.

Serious signs of computer indicators.

The publication of news reporting on the deterioration or improvement of the situation in any country, which is directly related to the value of its currency.

Messages from heads of state and central banks, which also greatly influence the attitude of investors towards the currency and the movement of rates.

The basis for this is how exactly traders, investors and large participants react to a particular event. Therefore, a specialist must be well versed in this in order to work. Learn this art yourself, the art, because it defies formulas, and you will be able to correctly predict the direction of the market.