Correlation of currency pairs: definition, calculation, application.

The efficiency of a trader depends on many factors, but one of the most important factors determining his professionalism is the ability to calculate and analyze statistical indicators. For example, the correlation of currency pairs helps determine how sensitive your total trading portfolio is to changes in the market at the moment. If it turns out that any increase will lead to a rapid decrease in profitability, action must be taken immediately. Also, without knowing the indicators that hide under the term forex correlation, it will not be possible to correct the behavior without errors. Knowledge of trends in the relationship between currencies provides reliable protection of the trading book against risks.

An Introduction to Currency Pair Correlation

Содержание статьи:

Answering the question: why currency pairs depend on each other, it is enough to give an example that is quite simple to understand. Trading the British Pound against Japan’s national currency, the Yen, can be represented as follows: GBR/JPY corresponds to GBR/USD and USD/JPY. This expression demonstrates that the initial GBR/JPY rate will be tied to one or both of the featured pairs, and there is an obvious forex correlation between them. However, although such a simplification explains the essence of the phenomenon, it does not always reflect the real behavior of currencies. Their pairs can rise or fall in parallel, but the opposite is true when more complex and unpredictable factors come into play.

In the general case, the correlation of currency pairs implies an indicator ranging from -1 to 1, the financial meaning of which is to demonstrate the relationship between two assets. If the correlation takes a value of -1, then they speak of a negative dependence: the movement of such a currency pair is 100% predetermined and has the opposite direction. Correlation of currency pairs with a value of 0 implies that their behavior is completely unrelated to each other.

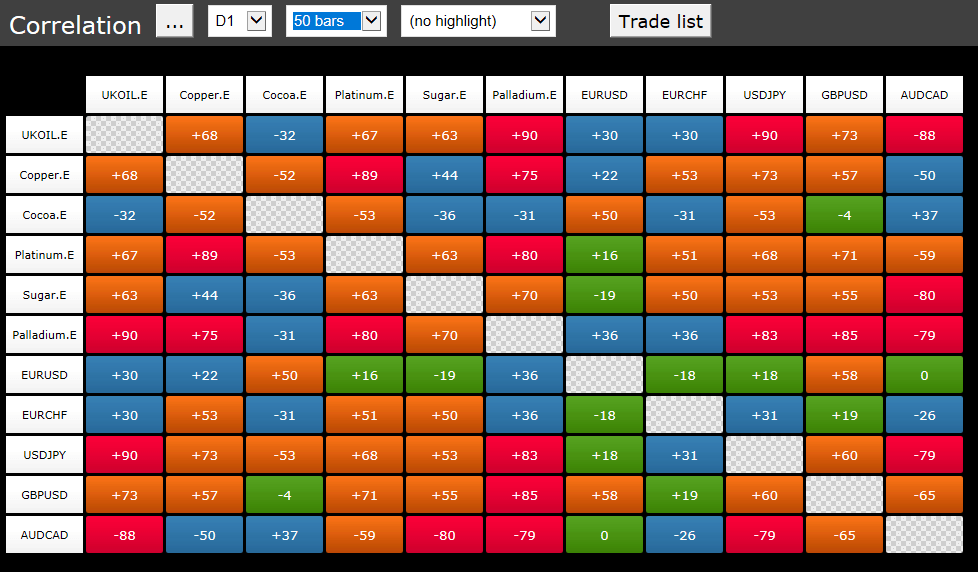

Forex correlation in tabular form

Once you have understood the definition of correlation and its meaning in application to the financial world, you should familiarize yourself with specific examples. The following tables show in a structured way how currency pairs correlated throughout February 2010.

According to the data in the first table, it can be seen that the forex correlation between EUR/USD and GBR/USD for February takes a significant positive value equal to 0.95. Therefore, an increase in the value of EUR/USD will in 95% of cases lead to a rally in GBR/USD. Over a longer period, 6 months, the currency pairs’ correlation drops to 0.66. However, the annual forecast continues to indicate the presence of a strong dependency, which makes no sense to deny.

If we take pairs like EUR/USD and USD/CHF as an example, then a negative correlation is seen and its value is very large and amounts to -1. That is, with 100% probability, a decrease in the USD/CHF ratio will be accompanied by an increase in EUR/USD. This trend will manifest itself for a fairly long period, since in all considered segments the value of the correlation practically does not change.

However, the situation described, when the relationship only slightly weakens or strengthens, is not always reflected in reality. Other currency pairs can be much less stable. USD/CAD and USD/CHF were strongly correlated with each other last year, their dependency ratio was 0.95. But the February 2010 figure shows a significant decline in the strength of the link, which may be due to a number of reasons, including the rise in the cost of a barrel of oil and changes in Bank of Canada policy towards tighter and more aggressive policies. . measures.

Fluctuations in the correlation of currency pairs

As the examples have already shown, the forex correlation is a rather variable and unstable value. In this sense, the importance of constant monitoring of its indicators is increasing considerably. After all, the mood of the foreign exchange market, as well as the state of the world economy, are fickle factors that are subject to daily change. The stronger, even perfect, correlation of currency pairs today is by no means a guarantee of the same long-term behavior. The most informative is the sliding correlation coefficient calculated on the basis of 6-month data. With it, you can get a more accurate and reliable forecast for the near future between some currency pairs.

Correlation changes are manifested due to various factors, the greatest influence is exerted by the monetary policy of states, changes in prices of various groups of goods, and a number of other economic and political reasons.

The table below shows what the moving correlation of currency pairs was for EUR/USD over six months.

Currency Correlation Calculation

If you want something done right, do it yourself. This common truth is also quite fair in relation to obtaining specific figures that are accepted by the correlation of currency pairs. Despite the apparent complexity, the calculation of correlation coefficients is not difficult if you know the correct sequence of actions.

Forex correlation can be obtained with just a few clicks using a spreadsheet such as the common Excel. The initial loading of exchange rate values is done using graphical software packages, many of which are completely free, and then imported into Excel. Then it is enough to use the built-in spreadsheet tools, ie the correlation function. In English versions of the program, it looks like “=CORREL (range1, range2)”, in Russified Excle’e “=CORREL (array1, array2)”.

As a rule, the calculation of the moving correlation is carried out for the period of one year, six, three and one month. Such a set of information is the most useful and convenient for analysis. However, the individual strategies and habits of a particular trader may require different time frames, as well as the number of indicators to be evaluated.

The sequence of steps during which the correlation of currency pairs will be obtained is as follows:

- Obtain price data for the currency pairs of interest (for example, GBR/USD and USD/JPY);

- Formation of separate columns in the spreadsheet under the corresponding pair of headings.

- Fill columns with daily prices for the period selected for analysis.

- Introduction to the column base of the CORREL or CORREL formula.

- Select the desired range of cells, enter it into formulas. You should get a similar line: =COREL(A1:A60;B1:B60).

The resulting value reflects the interdependence between the selected currency pairs.

Although the correlation indicator is constantly subject to change, a daily recalculation is not needed. It is enough to update the data every two weeks or a month.

Currency Pairs Correlation Indicator Application

Then, when the theoretical training in terminology and correlation calculations is complete, you can begin to describe the practical use of the existing knowledge.

Knowing the correlation coefficient can save you from many unreasonable decisions, including opening positions, the profits and losses of which are in balance. For example, the correlation of the currency pairs EUR/USD and USD/CHF is close to -1, that is, almost all the time when the value of one pair increases, the price of the second decreases. Therefore, a long trade in EUR/USD and the same trade in USD/CHF will no longer make sense: after all, a strong rally in the first position will be balanced by a sell-off in the second. On the other hand, another option, a long EUR/USD and also AUD/USD (as an option, NZD/USD), will almost double the position, which is due to a strong correlation with a plus sign.

The use of correlation coefficients also provides some reduction in currency risks by diversifying reserves. Let’s take EUR/USD and AUD/USD as an example. Their relationship is positive, but it does not reach 100%. Therefore, using these pairs will be a great opportunity to maintain a certain bias dictated by the market, but face minor losses in an unfavorable set of circumstances. If a trader is faced with the task of reflecting a bearish bias on the US currency, it would be more logical to buy not two lots of the EUR/USD pair, but one lot each of the EUR/USD and AUD/USD pairs. . Incomplete dependence on currency pairs requires the distribution of foreign exchange reserves in the hope of a possible minor loss.In addition to the fact that the correlation of currency pairs in this case is not perfect, the difference between the monetary policy of Australia and the European region is also taken into account. Therefore, a jump in the dollar may cause a drop in the euro, but the Australian currency will be more stable.

In addition, information about the dependence of the correlation is reflected in the calculation of the cost of trading positions. Returning to the example of the EUR/USD and USD/CHF pairs, let’s recall their almost complete negative correlation and present the value of each pip. So for EUR/USD the price is $10, while for USD/CHF the standard lot is $9.24. Therefore, a trade in the USD/CHF currency pair implies the possibility of successful risk hedging when making a trade in EUR/USD.

Let’s imagine that a market participant’s trading book has a short position for one lot of EUR/USD and the same position for USD/CHF. If the EUR/USD rate rises by 10 points, the trader’s loss on the advertised position will be $100. But given the opposite movement of the USD/CHF pair, the trader also makes a profit of about 10 points, which in monetary terms is $92.4. That is, the overall loss for the trader would be reduced from $100 to just $7.6. The negative scenario becomes much less profitable. But such hedging has a drawback: if the EUR/USD exchange rate falls significantly, the profit will also decrease due to losses in USD/CHF.

Obviously, whatever the operator’s strategy, updated information on the interaction of the correlation, its trends and changes will provide powerful support in making decisions on reserve diversification, search for alternatives and hedging, which will ultimately have an impact. income positive.