Federal Reserve System: What It Is And How It Works

The Federal Reserve System (Fed) is the most important money management organization in the United States. However, its influence is much wider, it has a strong impact on global economic growth, the value of money, and therefore all resources and goods. Let’s look at the work of this regulator, and talk about its functions and tasks.

What Is The Fed, And What Are Its Functions?

Содержание статьи:

- 0.1 What Is The Fed, And What Are Its Functions?

- 0.2 How And In What Form Did The Fed Come Into Being?

- 0.3 How The Fed Is Сurrently Structured

- 0.4 Key Differences Between The Fed And Other Central Banks

- 1 Fed Instruments

- 2 Myths About The Fed

- 3 The Effect Of Changes In The Interest Rate

On the one hand, it is still the same central bank of the state with the same functions and instruments of influence: controlling private banks, issuing money, setting the average interest rate on loans and deposits, etc. However, the Federal Reserve System is unique in its status: nominees for key positions are appointed by the U.S. President after consulting the Senate, but the owners are private individuals.

On the official website of the Fed, in the section with answers to questions, it is said that formally the reserve system does not belong to anyone. Due to its role as a central bank, the shares and decisions of this structure are especially important.

The purposes of the Fed are defined by the Federal Reserve Act:

- maintaining a balance between the financial and social spheres;

- protecting the interests of banking participants;

- issuing the dollar;

- control of the domestic financial market;

- acting as a depository for large organizations.

- supporting the functioning of payments within the country and between countries;

- maintaining liquidity.

The Fed has ample opportunities to influence not only the domestic but also the global economy, which we will discuss later.

How And In What Form Did The Fed Come Into Being?

In 1791, the First Bank of the United States was founded. It was responsible for paying off the national debt of the United States. It was planned that in 20 years this institution would be able to organize the issuance of the U.S. dollar and build a sound financial system. As in the case of the Fed, individuals played a big role: they owned about half of all assets. Exactly 20 years later, in 1811, the First Bank was closed, and in 1816 the Second Bank of the United States became responsible for stabilizing the dollar. However, it, too, was liquidated 20 years later.

For a long time banks were not centralized at all. Two periods are distinguished:

- 1837-1862. – The “free banking era”;

- 1862-1913. – The system of national banks.

The need for a unified system arose in connection with a series of financial crises in 1873, 1893, and 1907. Moreover, the year 1907 is remembered in history as the “banking panic” – the significant fall of the New York Stock Exchange. The situation was corrected then by John Morgan, who pledged his own money to strengthen the banking system and convinced other bankers to do the same. Now you can assess the degree of drawdown by the Dow Jones index.

The concept of the current Fed was established on Jekyll Island by a closed group of millionaires who managed to find a compromise between the interests of different groups.

The Fed was formally created in 1913 by the order of Congress. Thus:

- a significant amount of influence over the Fed was initially in the hands of individuals;

- financial systems with the same functions in the U.S. were already failing;

- minimal government influence over the Fed is historically inherent.

How The Fed Is Сurrently Structured

Since the creators of the Fed decided to move away from the familiar European system of central banks, the structure of the organization is quite unusual and at first glance, it seems complicated. The Fed consists of many sub-organizations and has connections to government and commercial entities. The most important structures related to the Fed are:

- Board of Governors. Seven governors are appointed by the president after consulting the board for a four-year term. One of them, by the president’s decision, becomes the chairman of the Fed. This board may not include persons who directly or indirectly influence the management of a bank or other commercial entity.

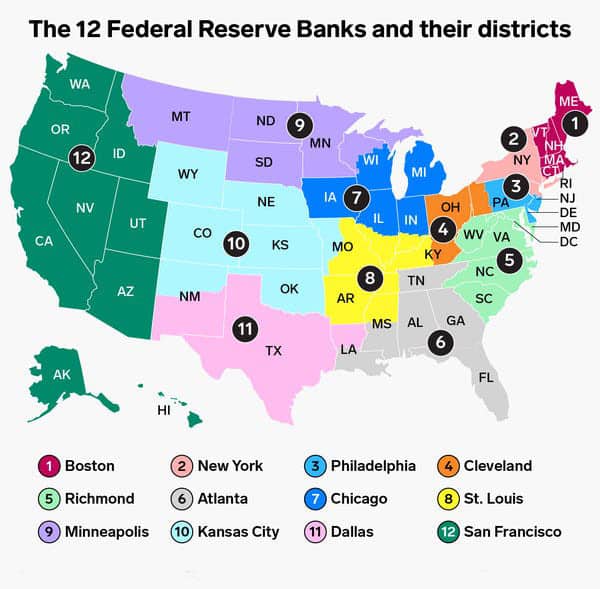

- Twelve federal reserve banks from various cities. Controlled by the Board, they are the principal instruments of influence on the domestic economy. It is through them that freshly issued dollars flow into the general financial system. They are private information and financial centers, peculiar intermediaries between the Fed and other banks. They have a board of directors of the reserve bank of nine people: three are appointed by the Board of the Fed, three are representatives of the largest banks, and three are representatives of the non-banking sector of the economy.

- Banks with Fed participant status. Hold shares of reserve banks without the right to sell them and with a fixed 6% dividend yield. They can participate in the election of the Board of Governors.

- Federal Open Market Committee (FOMC). It consists of seven governors of the Board of Governors of the Fed and five presidents of the reserve banks. Determines dynamics of dollar issuance, securities policy, and the lending rate. Along with the twelve reserve banks, it saturates the U.S. economy with the money supply.

The Fed does not issue dollars arbitrarily. They are issued against securities. Thus, the procedure of currency issuance is closely linked to the securities market and bond-issuing organizations. In this regard, the regulatory process begins to be influenced by another institution – the U.S. Treasury Department.

Key Differences Between The Fed And Other Central Banks

Of the features that have existed so far, the following are distinguished:

- Principle of capital formation. The capital is formed through the sale of shares. Commercial banks own the largest share of all shares, but their securities do not give them the right to vote and cannot be sold. This system is fundamentally different from traditional central banks. Their capital is usually formed either by the state or by selling shares. In either case, the state owns all or a decisive part of the system.

- Operating profits. The Fed is responsible for issuing money, that is, printing new bills. Generally, the proceeds are used to purchase U.S. Treasury bonds, and occasionally other assets. The Fed’s income is made up of interest yields from holding Treasury bonds and yields from other securities and banking operations. Although the Fed’s board and staff are not civil servants, their salaries are regulated by Congress. The funds that remain with the Fed after dividends and salaries are deposited into the U.S. Treasury’s revenue account.

- Autonomy. The Fed is given broad autonomy, but all of its activities are controlled, within a limited legal framework, through accountability and audits. Major reports are made to representatives and the Congressional Banking Committee. Also, at least once a year, the banks of the Fed are audited. Auditors do not review monetary policy and transactional activities, nor do they review the Fed’s open market operations. The full list of auditor credentials is governed by the Accounting and Auditing Act or the Sarbanes-Oxley Act.

Fed Instruments

The Fed’s main methods of influencing the U.S. economy are changing the Fed’s rate, carrying out open market operations, and reserve requirements for banks. The spheres of influence are divided between structural units. Thus, the Board of Governors is responsible for rate changes and reserve requirements for banks, while FOMC is responsible for open market operations. What is important for investors is how the use of these instruments affects the global economy.

The Impact On The Global Economy And The Fed’s Rate

The Fed is responsible for increasing the U.S. national debt. Part of this debt is made up of obligations on debt securities purchased by other nations and the Fed. This part of the debt is called public debt. Like all banks` key rates, the Fed Funds rate determines the interest rate at which loans are made to banks. The size of this rate depends on micro- and macroeconomics and its analysis by system experts. The degree and essence of the effect depend on which particular market segment is being considered.

The bond market is influenced directly – the higher the Fed rate, the higher the yield. The currency market is influenced more indirectly, but also obviously – the higher the rate, the more profitable the yield in dollars in comparison with currencies with a lower rate. The stock market is affected in the opposite way-the more attractive it is to invest in stocks, the lower the Fed Funds rate.

When the rate is low, companies’ businesses can grow faster. Many companies’ stock prices also rise as their capitalization and market capitalization in general increase. Thus, the lower the Fed rate, the stronger the economy grows. Sometimes it is necessary to slow down the rate of development to avoid an overproduction crisis and excessive inflation.

Myths About The Fed

Myth 1: The Fed’s Involvement In The Kennedy Murder

One of the major myths about the Fed is related to the assassination of U.S. President John F. Kennedy in 1963. After the signing of Executive Order 11110, the status of the Fed allegedly changed. The Treasury Department was given the right to issue money equivalent to their silver reserve (so-called silver certificates). That is, there was no need for the Fed to pay back the debt. According to this legend, the U.S. head of state was assassinated.

In reality, the decree contained nothing of substance, it only empowered the Fed. The Treasury Department had previously had the right to issue money on a limited basis. The fact is that the national currency issued by the U.S. Treasury had serial numbers that diverged from the bills of the Fed. The serial numbers were marked with different colors. One-dollar and two-dollar bills were issued by the Treasury, unlike the Fed, which had no right to do so. Incidentally, the Fed did not use taxpayer capital to finance its activities.

Myth 2: The Federal Reserve Is A Private Company

The Fed consists of a Board of Governors, which is the federal government. Because the System can issue stock, many assume that it is shareholder-managed, and thus is a publicly traded company. However, only a U.S. bank can act as a shareholder in the Fed. Monetary policy is solely under the control of the government.

Myth 3: The Federal Reserve Prints Money

The Bureau of Engraving at the Treasury Department directly prints it. The Fed buys finished cash from them at the cost of printing. The total value of this money must be equivalent to the value of the assets held by the Federal Reserve. The amounts of cash and non-cash currency held by the Fed are regularly published. Anyone can check it out.

Myth 4: The Owners Of The Fed Are Classified

The Securities Commission requires companies that trade stocks to report their major shareholders annually. The website of any regional bank provides a list of shareholders, and you can find out if that bank is a shareholder of the Fed.

Myth 5: The Fed Is Not Controlled By The Government

Each year the Fed Reserve reports to the Speaker of the U.S. House of Representatives, and twice a year reports on its activities to the congressional banking committee. These reports are publicly available. The Comptroller General of the United States also audits the Fed under the 1978 law.

The Impact Of The U.S. Federal Reserve’s Decisions On Each Trader

The fact that the system affects the world economy is clear, but how does it affect the trading of each trader individually? Taking certain measures to regulate the financial situation in the country, the U.S. Federal Reserve is guided by its economy, politics, and production situations in the country. Any changes affect many different areas at once. When the production system changes, stocks on raw materials, and companies’ securities go up or down, the issue of dividends is solved. We have already mentioned the impact on the dollar. It turns out that everything begins with the world economy (taking action) and ends with it. Another confirmation of the general circulation.

Moreover, the system supports not only commercial banks or government organizations but also enterprises of international scale, as well as the U.S. government itself. There is a complete normalization of trade. For example, when some disaster or difficult political situation occurs in a country, banks fall in ratings, currency and corporate securities go down as well, and the reserve system is engaged in normalizing this situation, helping to resolve it as quickly as possible.

Since the global economy affects all areas of the market economy, the stock market also falls under this definition. The value of securities of state banks and large enterprises directly depends on the quality of life in the country itself. The Federal Reserve manages the money supply, which helps reduce unemployment and provides optimal interest rates for banks. Consequently, the overall standard of living rises, securities prices return to normal, and institutions themselves improve their ratings by foreign agencies.

What Is The Federal Funds Rate

The Fed Funds rate is the percentage at which some financial institutions lend to others. It can be said that reserve funds are “traded” with this rate in mind. If one bank has excess funds, then it can lend them to banks with insufficient reserve funds. This scheme arises because of the need to maintain a certain amount of reserves at the Fed. Before the pandemic, the minimum allowable amount of these reserves was calculated as 10% of the total amount of funds in time deposits and checking accounts. In the spring of 2020, this requirement was eased; after the pandemic is over, it may return to the pre-crisis level.

In addition to the federal funds rate, there is also the so-called discount rate. It is used when working through the discount window – banks borrow money directly from the regulator. It is higher compared to the Federal Funds Rate and is fixed. This is done on purpose to make banks work less directly with the Fed and more actively lend to each other.

FFR changes most often occur during the next meeting of the FOMC. There are 8 such meetings during the year. Extraordinary changes in the Federal Funds Rate are also possible, but such a scenario requires extraordinary events in the economy.

What Factors Affect Changes In The Fed Funds Rate

The Fed’s key rate is not fixed. FOMC can change it depending on the state of the economy and the processes taking place in it. The regulator must ensure the stability of economic growth, changing the Federal Funds Rate is one of the most effective tools of monetary policy. History shows that this indicator has changed over a wide range. The maximum was in the 1980s, during which period the FFR approached 20%. Then it began to steadily decline and in the tens, it reached about zero. Rare bursts of growth occur during the periods corresponding to the crisis phenomena in the world economy and the U.S. economy. During such periods, rate increases are used as a tool to curb the growth of consumer prices.

There is no clear algorithm that would make it possible to determine the advisability of raising/lowering the interest rate. The regulator relies on a set of key macroeconomic indicators and monitors the processes taking place in the economy.

Such factors include:

- Inflation. The dynamics of the consumer price index strongly influence the regulator’s decisions. In 2022, inflation was breaking multi-year records and the U.S. Federal Reserve’s interest rate was rising steadily in response. This instrument was used as a kind of fire extinguisher – a way to quickly bring down the flames and slow the rate of inflation.

- Business activity, durable goods orders. When business activity declines and other indicators fall, it makes no sense to tighten monetary policy. During such periods, the FFR either remains unchanged or declines.

At the same time interest rate is not an ideal tool, an uncontrolled increase in the rate will solve the problem of inflation but will kill companies with a high debt load in the process. The regulator has to constantly balance between two extremes – ultra-soft and ultra-aggressive monetary policy.

The Effect Of Changes In The Interest Rate

The impact of the FFR depends on the specific market. For the stock market, an FFR increase is generally bearish, for bonds it is bullish.

Stock Market

An FFR increase is a bearish factor for the stock market. Loans are becoming more expensive and the burden on companies with high debt burdens is increasing. It’s harder for them to re-lend to service their current loans. This could lead to the freezing of new projects and a shift in the timing of launching new products on the market. Stock prices are likely to decline. Lowering the rate could provoke a revival of the stock market, and the stocks of companies are likely to rise.

This applies to the stock market as a whole, the dependence is best seen in the case of large indices. The securities of a particular company can fall/rise without being tied to the change in the interest rate. There are many factors influencing the stock quotes, and the influence of FFR adjustment may be leveled by other events.

The connection between these phenomena can be broken. For example, in 2020, after the coronavirus pandemic was announced, the rate fell to near zero. Simultaneously, the S&P 500 fell, meaning that the relationship of low FFR -> rising indices did not work. This is due to the general uncertainty, and the foggy prospects for a global economic recovery.

Bonds

When the U.S. Federal Funds Rate declines, so does the bond coupon, while the value of the bond rises. When the Federal Funds Rate goes up, mirror processes occur. In general, when the FFR goes up, the debt market comes to life. Bonds are a less risky option compared to conventional stocks. A rate hike leads to higher bond yields and increases the likelihood that the major indices will stop rising, perhaps they will go into a correction phase.

Bond yields can be adjusted by the value of the paper itself and by coupon yields:

- When the FFR goes down, the price of debt securities goes up, but the coupon goes down.

- When the FFR goes up, the bond price goes down, but the coupon goes up.

This relationship is always the same. Only the dynamics of bond yields and FFRs may differ. If, for example, the rate is lowered sharply, the yield on Treasury bonds will decline, but not as sharply.

Economy As A Whole

The FFR affects all interest rates in the U.S. It can be said that indirectly it affects all areas of the economy. The FFR rate affects employment, the unemployment rate, and the cost of credit for businesses and individuals. The level of the so-called prime rate depends on the FFR, which is the rate at which banks lend to the most solvent customers (large businesses). The prime rate affects conditions on other loans ranging from loans to buy a laptop to mortgage or car loans.

The Fed’s decision affects other economies as well. When the rate increases in the U.S. money begins to flow into the dollar and currencies of developing countries suffer because of this.

Currency Market

U.S. Federal Reserve interest rate directly affects the dollar against other currencies. When it increases, the U.S. dollar may strengthen, while when it falls — it declines. The dollar rate also depends on the policy of other central banks, so a change in the FFR does not guarantee a sharp rise/decrease in the US dollar. Much depends on the policies of other central banks. If, for instance, both the ECB and the Fed start to sharply increase interest rates, EUR/USD will most likely not see sharp fluctuations.

The behavior of the dollar index in the first half of 2022 is a good example of the connection between the dollar rate and the FFR decision.

The dollar index is a kind of barometer. It takes into account the dollar against six other currencies. The dollar index can grow faster than the other six currencies. This was the scenario for the first half of 2022.

What Will Rates Be Like In The Future

With each FFR hike, the Fed is getting closer to some kind of ceiling. There is no clear limit, but the regulator is prevented from raising rates indefinitely. This will solve the problem of rising consumer prices, but it will also cause problems for businesses with a high debt burden. This, in turn, will cause a decline in business activity, rising unemployment, and other negative processes in the economy.

While the limit has not been reached yet, it is believed that the Fed can raise the FFR to the level of 4.0-4.2%. This is the maximum allowable value at which inflation will slow down, but businesses will be able to survive.

Once the limit is reached, there will be no rapid decline in the FFR. Rates will remain relatively high for the next few years.

Criticism Of The Federal Reserve

You can hear a lot of criticism about the Fed because there have been missteps in decisions over its long history of management. For example, during the Great Depression of 1929, the regulator reduced the money supply instead of increasing it. As a result, the crisis dragged on for several decades. Some even blame the Fed for the outbreak of WWII.

During the 2008 crisis, the Fed acted very wisely and pumped money into the economy while keeping the interest rate at zero. This stopped the panic sell-off in the stock market and started a new round of growth. Although some believe that the Fed printed too much excess money which ended up pushing corporate stocks way up. Within 5 years, the stock market was already breaking new records. It is now over $30 trillion.

As Fed heads speak and decisions on benchmark interest rates are made, global markets wait nervously. After its release, stock markets and the dollar usually begin to move powerfully, depending on the market reaction. At the moment, the Fed is a sovereign debt creation machine. The U.S. is issuing more and more government bonds and selling them. The fact is that it can never pay off all the debt because the Fed prints the money.

Many people are confused by the opacity of this institution and the fact that it is completely private. Other central banks are owned by their countries:

- The German Federal Bank is 100% state-owned;

- The Bank of England is the Solicitor of the Ministry of Finance on behalf of the British government;

- 52% of the Swiss National Bank is de facto state-owned;

- The Bank of Canada has been a state institution since 1938.

It is legendary that all central banks and their policies are built under the Fed. However, some countries are not subject to the Fed: Cuba, Syria, Iraq, Iran, Libya, and North Korea. All of these countries are very poor. Though much of this is due to isolation from world trade. Central banks are not allowed to print their local currency as much as they want. They are required to hold the same number of dollars in their reserves. Because of this, the world system is very tied to U.S. dollars.