Minstrel cycles

1. Are there Minstrel cycles in the US economy? Mitchell’s substitution of Minstrel cycles for “business cycles”.

Содержание статьи:

- 1 1. Are there Minstrel cycles in the US economy? Mitchell’s substitution of Minstrel cycles for “business cycles”.

- 2 2. The impact of the Minstrel cycles on the political affiliation of US presidents

- 3 3. Causes of the double whammy in the growth cycle 1975-1982. and the beginning of the post-industrial era

The deep economic crisis and depression that engulfed the world economy in 2008-2012 once again confirmed the fact of the permanent instability of the market economy. The crises and recessions of different depth and duration in the last 200 years are immanent to the market economy. This fact was very clearly defined by Professor Sergey Gubanov in the article “Cyclicity: a form of crisis”. In fact, it is precisely the crises that complete the cycles that represent a kind of break with gradualism, the limit state of the market economy, which we have observed today since 2008.

It is not surprising that already in the XIX century, at the beginning. 20th century crises and cycles have attracted much attention from leading economists. However, they were mainly economists from France, Germany and Russia. So, the greatest researchers of cycles can be called Juglar, Marx, Tugan-Baranovsky, Spitthoff, Leskyur. As a consequence, today the periodic cycles of 7 to 11 years are commonly known as Juglar cycles. Although this is not entirely accurate.

Paradoxically, the economists of the cyclical leaders: England and the United States, where the Juglar cycles manifested themselves earlier and more clearly, in fact, were interested in them almost exclusively as empirical or punctual phenomena. The key to this paradox was that economists in England and the United States were closely involved in corporate and state economic management, making their economic views excessively empirical.

It is true that this did not happen immediately, but during the maturity of the industrial age. Adam Smith and David Ricardo were quite up to the task of economic theory. However, from John Stuart Mill and, especially, from A. Marshall and the monetarism of I. Fisher, the economic thought of England and the United States moved towards the positions of economic empiricism. Surprisingly, even at the height of the Great Depression in 1933, when the number of unemployed in the United States reached 15 million, and American banks, in fact, all went bankrupt, I. Fisher, one of the leading economic advisers to the President Roosevelt. , he denied the periodicity and regularity of the cycles.

It is not surprising that it is precisely from 20-30 that the theory of cycles is replaced by the statistics of the conjuncture. Mitchell’s Economic Cycles (1927) played a key role in this process. In it, the author directly rejected Juglar’s theory of periodic cycles, replacing it with statistical and, in fact, random, 3-4-year cycles. With this, on the one hand, economic science moved on to the study and solution of specific questions of economic life. But on the other hand, a series of the most important economic problems studied by economists in the early nineteenth century. The 20th centuries, in fact, were discarded.

Moreover, even the concept of “crisis” rejected Mitchell, introducing a neutral concept – “recession”. “…statistical researchers, who take credit for always following the directions of their data, rejected the term… They called the transition from boom to bust a recession. As a result, the cycles they note are, on average, shorter than the cycles established in crisis writing: they consider typical cycles not 7-8 years, but 3-4 years.

Keep in mind that today, in the 21st century , the global conjuncture has an almost mathematically exact Juggler cycle of 8-9 years!! The dates of the cycles of the post-industrial era are shown below: 1975-1982, 1983-1991, 1992-2001, 2002-2009.

Furthermore, as we will see below, even the succession of US Presidents almost exactly matches the Minstrel cycles of the last 50-60 years!

The shortcomings of a purely statistical approach were already apparent in the 1920s, when the Mitchell school was being formed. So, really deep periodic crises: post-war 1920-1921. and the most devastating crisis in the history of 1929-1932. they were equated with the prolonged recession of 1923-1924. and decline in 1926-1927. As a result, the most important achievements of qualitative analysis were sacrificed for a simple statistical statement of market fluctuations. And when the “Great Depression” began, the Mitchell school had nothing to offer to explain the causes of the economic collapse.And it’s no wonder that even Mitchell’s very concept of “crisis” was rejected and replaced with “recession.” While in reality the US economy was not even experiencing a crisis, but a true decline, moreover, for a whole decade, since after a slight recovery in the middle. 30s in 1938-1939 the crisis has returned.

At the same time, the Mitchell school, in fact, denied the existence of long conjuncture cycles. As a result, the problems of periodic Juglar cycles as a fundamental phenomenon of industrial economics completely disappeared from the studies of American and British economists.

It is true that the “Great Depression” forced all Western economists to tackle the problem of cyclicality. But even in the extremely extreme conditions of the 30s . XX, the highest result of Anglo-American economic thought was the theory of Keynes (1936). Even G. Haberer, who, fulfilling the task of the League of Nations, generalized all available theories of the “business cycle” of the 20-30s, eventually switched to the position of the Keynesian theory. But his main task was to develop an economic regulation of the economy that would minimize cyclical fluctuations.“An effective means of combating business cycles is not to be found in eliminating booms and establishing a chronic semi-depression, but in eliminating crises and constantly maintaining a near-boom state.”

In other words, Keynes was far from understanding cyclicality as the dynamics and change of Juglar’s cycles. That is, far from the theory of cycles. As you know, it was at this time that J. Schumpeter tried to create a sketch of a unified theory of cycles based on the innovative concept and great cycles of N. Kondratiev. But, he couldn’t do it convincingly enough. After all, the erroneous hypothesis of his scientific mentor Tugan-Baranovsky was at the heart of N. Kondratiev’s theory of great conjuncture cycles. And governments, like the vast majority of economists, sought to find measures to precisely eliminate or at least mitigate “business cycles.”

It is true that in the economic history of the United States there were also objective reasons to replace studies of Juglar’s cycles with “business cycles”. For example, in the XIX century. only the cycle of 1849-1857 manifested itself more or less definitively. Previous cycles 1816-1826, 1827-1837, 1838-1848 due to the underdevelopment of the industrial sector of the economy, were expressed rather weakly. Furthermore, even this weakly expressed cyclicality had, so to speak, the opposite manifestation. The point is that on the floor. 19th century United States played the role of an appendage of raw materials in relation to industrial England.Therefore, the cyclical crises were reflected in the US economy several years later. Thus, the industrial crisis of 1837-1838. in the United States in full force it manifested itself only in 1842.

Furthermore, even after 1857, the cycles in the US did not synchronize with the cycles in England, since in 1861 the Civil War of North and South began, which not only disrupted the emerging cyclicality, but also undermined the US financial economy system by issuing a large mass of paper currency money – greenbacks. However, despite this, following the crash of 1873, the Minstrel cycles in the American economy during 1874-1903. They were quite visible. So, we can highlight the cycle of 1874-1883, the cycle of 1884-1893. and the cycle of 1894-1903.Almost the same years of periodic crises were named by the most outstanding researchers of the Minstrel cycles: Minstrel himself, Tugan-Baranovsky, Lescure, Bunyatyan and others.

Thus, Juglar cycles in the American economy at the end of the 19th century. they were fairly traceable, although they did not exactly match the cycles of Germany and France. But the differences were only one year, and even with France they completely coincided. The only exception is the 1894-1903 cycle. and the cycle of 1904-1907. True, in 1900 there was a recession in the US, but it was overcome and the rise continued. Here we see a vivid fact of the phenomenon of “overlap”, when the cycle lasted 2-3 years due to the cycle that replaced it. A striking confirmation of the fact of the presence of “overlap” is that the cycle turned out to be, albeit unprecedented – 1904-1907, but, nevertheless, extremely typical!The stock market crash of 1907 shook not only the American financial system, but the entire American economy. It was after this collapse that business and the government of the United States created the Federal Reserve in 1913.

Note that the analysis of cyclicality during the World War II years was especially difficult. In fact, it has not been carried out so far. The more important question is how economic cyclicality turns into military cyclicality and how the reverse process proceeds. Note that economic contradictions were the most important cause of the outbreak of world wars. Furthermore, it was through cyclicality that these contradictions turned into military confrontations. Both World War I and World War II arose at the end of the cycles of innovation and the beginning of the cycles of change in 1914 and 1939. Consequently, dry statistics can do little to explain these facts.

For example, the United States in the 1930s produced 200-300 aircraft per year, in 1942-1944. 40-50 thousand per year. Increased production by almost 200 times! And so with almost all types of military equipment. And in 1945-1947. due to conversion, a large decrease in production. Including the drop in GDP dynamics. But does this mean that we must for the period 1939-1948. assign multiple cycles? From a purely formal and statistical point of view, in terms of bare numbers, they should. But from the point of view of the study of all reality, no. Because cyclicality is characteristic not only of the industrial economy, but also of industrial policy. And in the cycle of 1939-1948, it was not the economic, but the political dominance of cyclicality that dominated.

Therefore, the economic entry into the war and the exit from it (conversion), from the point of view of the theory of cycles, must be considered as a single cycle of turn 1939-1948. The same is true for World War I, which took place in the 1914-1921 turn cycle. In other words, the events of World War I and World War II took place in the same periodic Minstrel cycle.

Therefore, it is clear that the study of cyclicality as a purely economic phenomenon (statistical) or as a purely political phenomenon (Gattei and others) does not provide a real explanation of industrial cyclicality. Only a synthetic approach, taking into account economic and political factors,

But even after the Second World War, in some cycles, the strong influence of the political factor made itself felt. Thus, in the cycle of 1949-1958. The Korean War of 1950-1953 had a great influence on the economic situation. Suffice it to say that during the war years, the proportion of US GDP spent on military needs exceeded 15%. For comparison: in the Reaganomics years, when the SDI was created, military spending was only 6%, and in the 2000s no more than 3-4%. Naturally, high military spending led to the deformation of the Minstrel cycle. The end of the war in Korea and the conversion caused an economic recession in 1954. But there is no reason to consider it a separate cycle.The processes of unfolding the cycle continued, and in 1955-1957. The US economy has entered a boom phase. And in 1958 there was a periodic economic crisis without any war.

Similar events took place in the next cycle, which in the United States lasted from the Vietnam War into the 1970s. Note that the 1959-1970 cycle. it was a typical cycle of innovation. The United States experienced rapid economic growth, introduced basic and improvement innovations. But in 1965, the Johnson administration dramatically increased military intervention in Vietnam. Military spending jumped again, exceeding 9% of GDP. This caused an artificial investment boom. As a result, the cycle that was supposed to end in 1967-1968 ended in 1970. At the same time, exactly in 1967, the American economy experienced a recession.Particularly in industries operating in the consumer market due to the drop in personal consumption in 1967-1968, when the cycle of innovation should have ended, were it not for the sharp rise in military spending.

Note that, despite the military warming of the situation, the Democrats lost the 1968 elections. This is further evidence of the correlation between domestic politics and Juglar cycles. Also, the next cycle of 1970-1975. it turned out to be very short, from the 1959-1970 cycle. it was prolonged by the enormous costs of the Vietnam War. It is worth noting that in Europe, particularly the FRG, which was not affected by military spending, the cycle ended precisely in 1967. Other leading Western European countries, for example England, also experienced a recession in 1967.

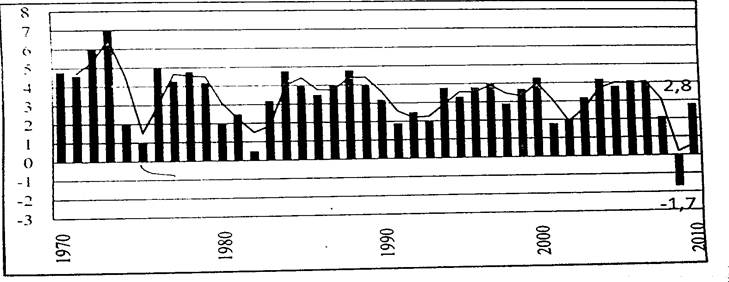

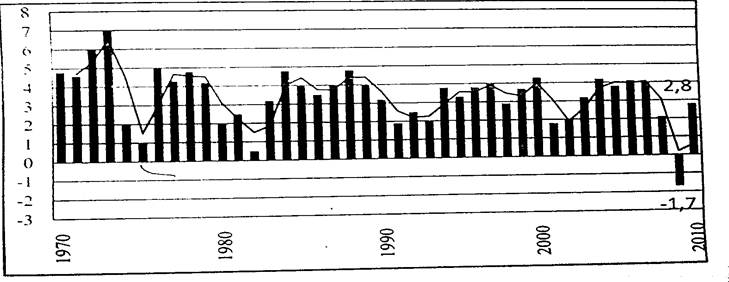

Thus, despite the profound political upheavals of the 20th century, we can fairly confidently identify the Minstrel cycles in the US economy as the leading cyclical of this era. From the moment the political convulsions began to weaken: from being. 70, the Juglar cycles appeared with all evidence. And not just in the US economy, but in the entire global economy. The dynamics of world GDP, according to the World Bank, clearly testifies to this.

In this table, the cycles of 1975–1982, 1983–1991 and 1992–2001 are clearly distinguished. and 2001 to 2009. Furthermore, the same cycles in the US economy repeat almost exactly the dynamics of the cycles in the world economy.

2. The impact of the Minstrel cycles on the political affiliation of US presidents

As we have seen, business cycles are very closely related to political events. It is natural to assume that cyclical developments also have a strong influence on political processes in the United States. It is true that in the nineteenth century, when England was the source of industrial cycles, the cyclical development of the United States was asynchronous. The cyclical recession in England, and then in Europe, came earlier and in the US with some delay. Even the cycle of change at the end of the 19th century was completed in Europe in 1900, while in the US it was only in 1903.

But after World War II, when the center of the global market economy finally shifted to the United States, cyclical and political processes showed clear tendencies towards convergence. Already the coming to power of the Republican Eisenhower in 1952 marked this rapprochement. His reign spanned most of the 1949-1958 cycle. But the coincidence of the Juglar cycles and the periods of change of government between Republicans and Democrats is especially clear from the sixties.

As you know, Democrat Kennedy became president that year and the Democrats were in power until 1968, which almost coincided with the end of the 1958-1967 cycle. The Republicans who won the 1968 elections also remained in power for 2 terms until 1976, which also almost coincided with the 1968-1975 cycle.

Only the 1975-1982 cycle. relatively to a greater extent it did not coincide with the change of parties in power. Democrat Carter’s presidency fell in 1976-1980. But, the cycle of 1975-1982. it was the beginning of the post-industrial transformation. It was a short cycle. Furthermore, it seemed to be divided into parts. In 1975-1979 there was a rapid growth of the old industrial sectors, but then production in them began to decline sharply, and in the second half of the cycle in 1979-1982. there was a rapid growth of already post-industrial sectors.

So it was a decisive cycle, which was reflected in the replacement of the Democrats by the Republican administration of Reagan in 1980. Thus, the Democrats were in power for only one presidential term. But the Republicans were in power for 3 terms from 1980 to 1992. The last date will almost coincide with the end of the 1983-1991 innovation cycle. In addition, the mandate of the Democrat Clinton in the period 1992-2000 almost coincides with the following cycle of 1993-2001.

Finally, Republican Bush Jr. was in office almost exactly during the 2002-2009 cycle.

Thus, the change in power of the parties and cycles since 1960 occurred as follows:

1952-1960 Republicans 1949-1958

1960-1968 – Democrats, 1959-1967

1968-1976 – Republicans, 1968-1975

1976-1980 – Democrats, 1975-1982

1980-1992 – Republicans, 1983-1992

1992-2000 – Democrats, 1993-2001

2000-2008 – Republicans, 2002-2009

2008-20…? – Democrats, 2010-circa 2017

Perhaps, for some, the coincidence of the change of parties in power and the Juglar cycles does not seem accurate and convincing enough. Therefore, for comparison, we can take the change of parties in power in the second. flat. XIX – beginning. XX and be. 20th century Thus, after the Civil War, the Republicans in the second. flat. 19th century they were in power for several decades in a row! In contrast, the Democrats, with the start of the Great Depression and World War II, served 5 terms in a row from 1932 to 1952.And only after the Republican Eisenhower came to power did the correct change of parties in power begin, closely coinciding with the change of cycles.

What is the reason for the apparent convergence of economic and political processes in the United States? We have already named one of them. This is global leadership, which means the decisive influence of the US economy on post-industrial cyclical developments. The other is the absence of major political confrontations, such as civil war or World War II. As well as major economic shocks like the Great Depression. The third reason can be seen in the change in the nature of the short cycles in the second. flat. 20th and early 21st century Crises and depressions have become shallower and more prolonged.Information technology played an important role, making it possible to respond more quickly to changing market conditions and declining product balances.

However, the last short cycle of 2002-2009. with an unprecedented rise in oil prices and the stock market crash in the fall of 2008, it may mean a weakening of the close dependence on political and economic processes in the United States. For example, the new US president, Barack Abama, can remain in power not for most of the new cycle, but only for 4 years, just like Carter in the late 70s. Especially since the 2010-2017 cycle . in many ways it will be a turning point in the evolution of post-industrial society.In addition, Obama faces the most difficult political task: to initiate a withdrawal in foreign policy, that is, to reduce some of the most hateful manifestations of American globalism. And, as you know, withdrawal is always subject to severe criticism, even if withdrawal is the only way out.

3. Causes of the double whammy in the growth cycle 1975-1982. and the beginning of the post-industrial era

Let us pay attention to the 1975-1982 cycle to understand in more detail the causal dependence of the economic and political ones. Furthermore, much has already been written and said about the double recession of 1980 and 1982 as a model for the current 2009-2017 cycle.

In this cycle, the credit and financial factor and, consequently, the rise in prices were of great importance. In particular, a great impact in the course of the 1975-1982 cycle. it had the collapse of the Bretton Woods financial system and the jump in oil prices in 1973. Even after the cyclical crisis of 1974, the rise in prices did not stop. So, if a ton of oil in 1972 was offered for 25-30 dollars, in 1979 OPEC raised prices to 250-300 dollars. Consequently, there was a jump in the prices of other goods. In response to OPEC’s actions, US President Carter proclaimed the slogan: “A bushel of grain for a barrel of oil.”As a result, Western companies have sharply increased the prices of oil production equipment.

Not surprisingly, a large-scale search for energy alternatives to oil began in the 1970s , the results of which are still important today, when oil prices reached a new high in 2008.

The double break in the 1975-1982 cycle is not particularly interesting. Business activity fell sharply at the end of 1980-1981, and then in 1982 there was a cyclical downturn. After analyzing the statistical data from the return of the 70-80s. you can find the reason.

Economic turmoil 1973-1974 were partially overcome already in the second. flat. 1970s In addition, there was an increase in production in traditional industrial sectors. In the United States from 1975 to 1977 , automobile production grew from 9 million to 15 million, and the automobile industry in Japan, the FRG, and France grew. Steel production has stabilized.

But these were the last years in which the traditional industrial sectors set the pace of economic development in the leading countries of the global market project and, above all, in the United States. During the last three years of the same growth cycle (1975-1982) from 1979 to 1982, the production of steel in the United States decreased almost 2 times: from 124 million tons to 66 million tons! Such a drop was only during the years of the Great Depression. It should be noted that in the next cycle of 1983-1991. Steel production no longer exceeded 90 million tons. The drop in pig iron production was also very significant in the US. Similar processes were observed in the economies of Germany and Japan.

At the same time, be. 1970s 4th generation computer systems have already been created, which have become the technological and informational base for the beginning of the transformation of the industrial economy into a post-industrial one.

It is to be. 1970s Production of personal computers begins to grow rapidly. If in the USA in 1968 they were produced in the amount of 4.2 billion dollars, then in 1978 in the amount of 16.6 billion dollars, and in 1981 already in the amount of 30 billion Dollars. Average annual growth rate from 1972 to 1982 represented almost 19%. Robotics developed rapidly, in 1974 the first commercially available T3 robot, controlled by a minicomputer, was created. These two directions in the development of post-industrial production turned out to be closely interconnected.The development of robotics is impossible without computerization, and robots are widely used in the production of electronic components. From sec. flat. 70s too early In the 80s, the number of robot models offered for sale increased 10 times, the amount of which increased from 30 million dollars. in 1980 to 190 million dollars. in 1982

It developed even more rapidly in the late 70-80s. biotechnology, another important post-industrial industry. Only in Japan to be. 80s the production of microbiological products amounted to a huge amount – 50 billion dollars.

Consequently, when industrial sectors experienced recession and stagnation, post-industrial industries began to develop rapidly. Growth cycle 1975-1982 became the first cycle of the post-industrial era, which entered the global market project. But this did not mean a single and simultaneous destruction of the entire industrial structure of production and the construction of a new post-industrial structure in its place. In fact, profound sectoral changes took place and the small industrial sectors combined organically with the newer ones.

Therefore, it is clear why the cyclical development of the global market project was preserved during the transition to the post-industrial era. The flexibility of the new industries could not compensate for the sharp drops in market conditions caused by the structural contraction of the old industrial sectors. In addition, in the context of the beginning of the connection within the framework of the global market project of its leading centers and the former colonial and semi-colonial periphery of Asia, Latin America and Africa, part of the industrial production did not completely disappear. , but was transferred to this periphery. As a result, the industrial sector of the world market economy remained almost at the same volume.

It is not difficult to understand the cause of the double break in the growth cycle of 1975-1982. there were profound technological changes that developed later in the innovation cycle of 1983-1991. It was a typical preemptive recession, and at the same time an example of an overwhelmed cycle, when innovation clusters began to develop as early as the 1975-1982 cycle.

Economic and technological processes of the turn of change of the 70-80s. political changes have also been consistent. Republican Reagan’s victory in the 1980 elections was a reflection of the need for a change in the economic policy of the US state. As you know, it was later called regonomics.